NewsVoir

Pune (Maharashtra) [India], September 29: The 2025 festive season has brought with it a wave of joy, tradition, and togetherness. Homes across India are starting to light up with colours, laughter, and of course, new electronics and appliances. Such an auspicious time should welcome much-awaited purchases, but the financial strain could easily cast a shadow over an otherwise happy occasion. That is where Bajaj Finserv’s financing options come in. They help ease the pressure of lump-sum payments and give you control over your financial planning.

Stress-free shopping with Bajaj Finserv’s financing options

Bajaj Finserv’s customer-centric financing solutions make festive shopping accessible and affordable. They allow you to spread the cost of your purchases over a tenure that you are comfortable with. Select products even come with zero down payment offers. Instant approvals on your EMI eligibility, and a network of 1.5 lakh+ partner stores across 4,000 cities make shopping convenient. Moreover, Bajaj Finserv’s financing options provide you with offers and tools to further empower you. Here is how you can make the most out of them:

1. Blockbuster EMI Days: The hottest sale of the season

Blockbuster EMI Days are a highly anticipated seasonal sales event that brings irresistible deals on the best products. This event offers customers an opportunity to maximise their savings far beyond standard financing rates.

Highlights include:

– Exciting cashbacks and exclusive partner offers

– Time-limited exclusive deals on in-demand products

– Special zero down payment schemes

2. Maha Bachat Savings Calculator: Ensure you never miss an offer

The Maha Bachat Savings Calculator is a smart tool that shows you the total savings you can enjoy when shopping at Bajaj Finserv partner stores. This tool helps you maximise discounts along with the convenience of Easy EMIs.

Benefits include:

– Combine all applicable brand discounts and dealer offers

– Maximise your total savings

– Enjoy deals available exclusively to Bajaj Finance customers

3. Easy EMI Consumer Durables Loan: The power of planned payments

Bajaj Finserv’s Easy EMI loan enables you to purchase over 10 lakh products with flexible tenures ranging from 3 to 60 months.

Features include:

– Loan of up to 5 lakh with minimal documentation

– Quick loan approvals within a few minutes

– Zero down payment on select products

– Pre-approved offers for eligible customers

– Available at over 1.5 lakh partner stores across 4,000+ cities

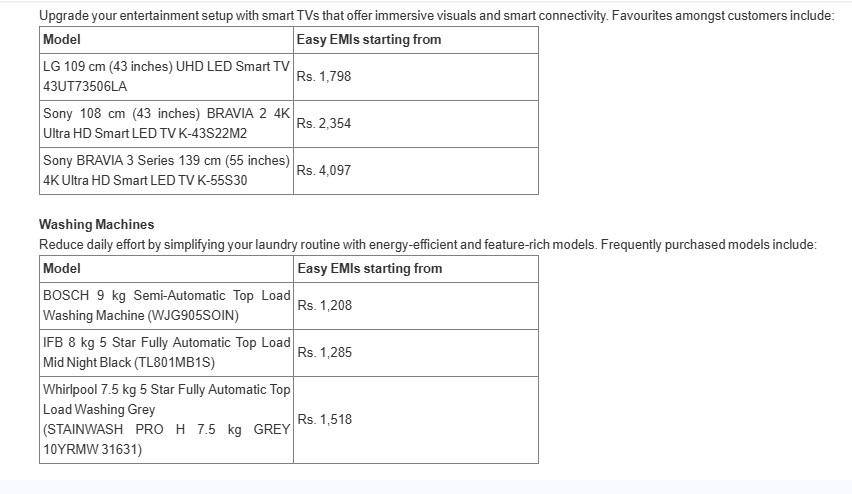

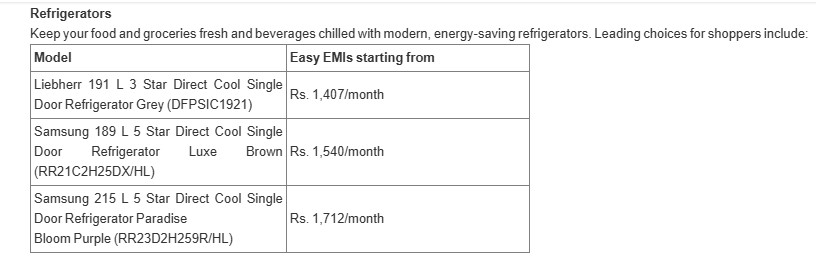

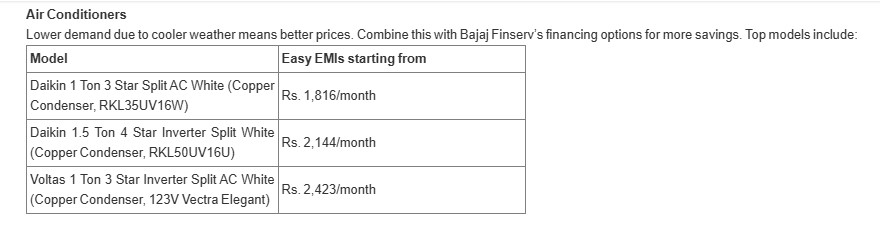

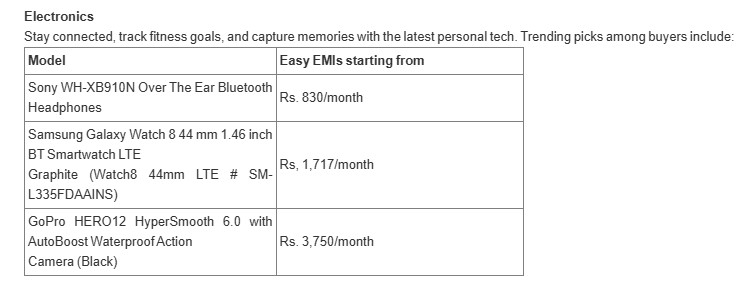

Top products available with Bajaj Finserv’s financing options

The extensive reach of Bajaj Finserv’s financing options covers every product category essential for a modern home and lifestyle upgrade. Here are the top-selling products available on Bajaj Finserv’s financing options:

Televisions

Make this festive season shopping truly rewarding

With Bajaj Finserv’s financing options, you no longer need to compromise on your festive wishlist. The combination of Easy EMIs, zero down payment, and exclusive offers ensures that your celebrations remain joyful and financially sound. Follow these steps to get started:

– Explore products, offers, and deals on Bajaj Mall.

– Calculate your savings using the Maha Bachat Savings Calculator.

– Visit one of 1.5 lakh+ partners stores across 4,000 cities in India.

– Select the Bajaj Finserv Easy EMI Loan at checkout and ensure that you club all your offers together.

Furthermore, you can make the process even more seamless by:

– Checking your loan eligibility online to know your pre-approved limit instantly.

– If you already have the Bajaj Finserv EMI Network Card, you can convert purchases of up to 3 lakh into Easy EMIs for a fast, paperless checkout.

Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 69.14 million customers. BFL has the highest domestic credit rating of AAA/Stable for long-term borrowing, A1+ for short-term borrowing, and CRISIL AAA/Stable & [ICRA]AAA(Stable) for its FD program. It has a long-term issuer credit rating of BB+/Positive and a short-term rating of B by S&P Global ratings.

To know more, visit www.bajajfinserv.in

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages